College Debt; It’s Over

For most college students, tuition is a burden. Whether it’s the student paying it, or the parent(s), it’s not easy on anyone. Recently, there has been a lot of talk about lessening the tuition for college in order to make college debt free. But how exactly will candidates put that plan into motion?

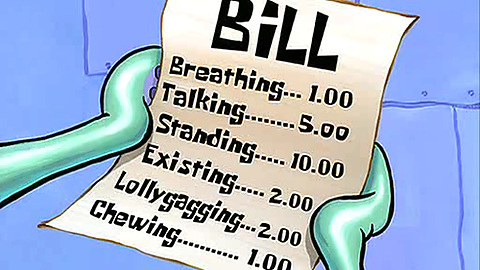

Politifact classifies the federal government as an “exploitative lender” when it comes to student loans. Elizabeth Warren, recognized as one of the nation’s top experts on bankruptcy says the most recent reports state that the total United States student loan debt is $1.26 trillion, and there are 44.2 million Americans with student loan debt. Between 2004 and 2014 in-state tuition and fees rose 42% after adjusting for inflation. The loans that were put out between 2007 and 2012 are supposed to produce $600 billion in profits for the United States Government. As of right now, student loans are to generate $135 billion in profit from 2015-2024.

The Democratic party outlines in their platform that one of the principles and policies that they support is “Making Debt-Free College a Reality.” Democrats feel as if every child, no matter how much their families earn or where they live should have access to high quality education beyond high school. They feel that if a person wants a higher education, that they should be able to get one without the cost of tuition being the barrier. A college degree is required today in order to get a middle class wage-paying job. But sadly, graduation rates have decreased for students of low income.

The Democratic Party’s idea to make college debt free sounds good. But how do they plan to put this idea in motion? According to Time Magazine, Hillary Clinton is proposing a plan called “The New College Impact.” Clinton wants to significantly cut the interest rate on student loans, and offer free tuition at public and community colleges, and in state four year schools by 2021 for students whose families whose have an annual income of $125,000 or less. She wants to introduce the plan to the public in increments by making families who earn $85,000 eligible first, and then gradually increasing the threshold until it reaches $125,000 in 2021.

In order for this plan to follow through, everyone will have to do their part. Clinton mentions in her campaign that the plan will be fully paid for by limiting certain tax expenditures for high-income taxpayers. The total cost of the plan will be in the range of $350 billion over 10 years. More than half of the total will go towards grants to states and colleges. These grants will ensure that students do not need to take out loans for tuition and help students who live on campus at 4 year public colleges with room and board fees.

Clinton also states in her campaign that around one third of the funds will go toward relief on interest from student loan debt. This will allow Americans with a significant amount of student loans to refinance their loans to the most up to date lowest interest rate, and cut interest rates to make it easier for students to enroll in income based repayment which helps avoid overwhelming debt. There is also hopes to reduce the burden for future borrowers by significantly cutting interest rates on undergraduate student loans so that the government does not make a profit off of undergraduate student loans by reducing monthly payments for student borrowers. Hillary wants to use the remaining funds to support innovative new investments to create a higher education system for the 21st century, such as rewarding college completion and enrollment, and offering more support for student parents.

The Republican party mentions in their platform that in order to reduce student loan debt, it would be better for citizens to look for loans from private banks instead of borrowing from the government. Republicans feel as if this will bring more business to banks if students went to take out private loans. It is believed by Republicans that if students take out private loans from banks, the cost of college would be easier on students and families because the banks would be in competition with each other which will then result in them offering lower interest rates, unlike the federal government which only offers one interest rate.

Hillary’s plan alongside the Republican plan to lessen student loan debt sounds much better than the Republican parties. Its sounds almost like Republicans do not want to get rid of student loan debt, but keep their money in their pockets by students taking out private loans instead of from the federal government. Hillary is making the effort to lessen student loan debt and or get rid of it by using tax dollars of the wealthy.

College tuition and unmanageable student loan debt is really a huge issue. Especially because in today’s world, if you don’t have a college degree then the chances of you making a decent living is the flip of a coin. With that being said, a lot of people are now making it a priority these days to obtain a college degree and sometimes they can’t afford it, so taking out loans in order to pursue their education is the only option. I hope Hillary Clinton really follows through with this plan because 44.2 million Americans, plus more to come, are in need of its implementation.